Suncorp Bank joins buy now, pay later trend

Suncorp Bank is excited to announce PayLater, our new interest-free Buy Now Pay Later offering which can be used to make payments at more than 70 million… | 16 comments on LinkedIn

Suncorp to launch buy now pay later services from November

Suncorp Bank enters buy now pay later market with Visa News 6 September 2021 Suncorp Bank has today announced PayLater, its new interest-free Buy Now Pay Later (BNPL) offering which can be used to make payments at more than 70 million merchant locations worldwide, wherever Visa is accepted.

buy now pay later Buy Now Pay Later or credit card? You choose EconomicTimes

The bank unveiled the new product in September 2021 and has billed it as a 'pay later debit card', which has been reported to be more like a credit card that charges no interest or ongoing fees. The service called 'PayLate' is available at around 70 million locations globally, or wherever Visa is accepted, and the service would be.

SUNCORP Adult Now Pay Later Brightworks

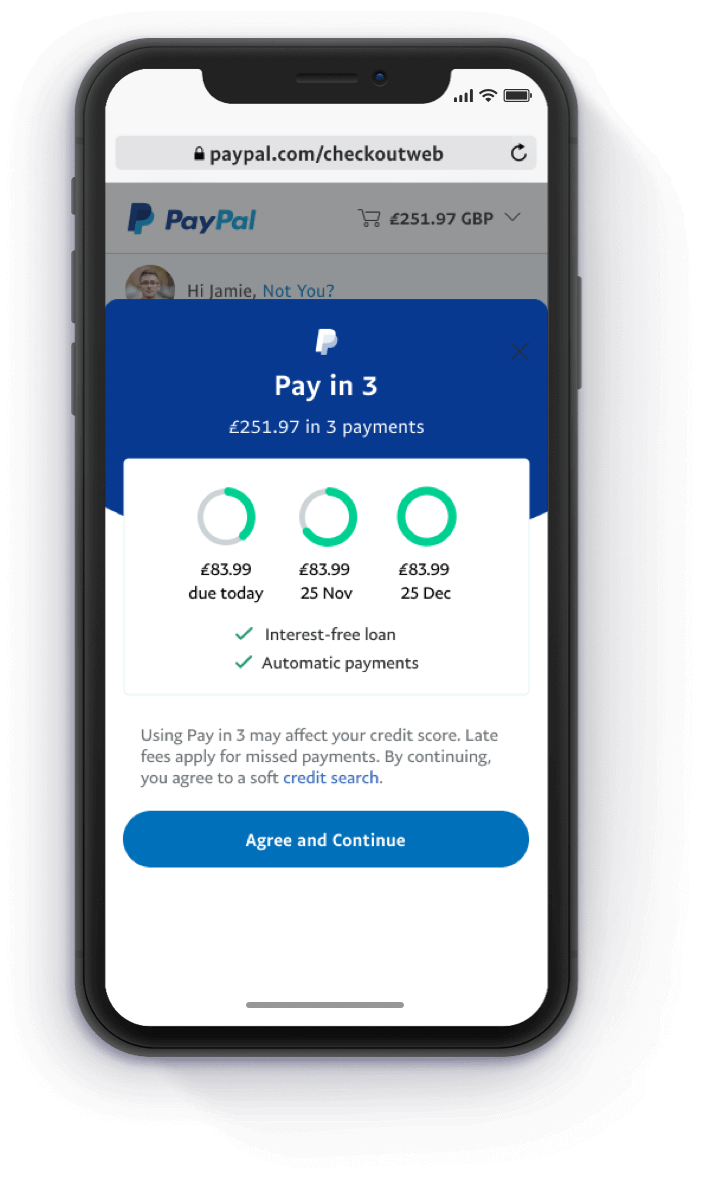

After applying successfully for a Suncorp Bank PayLater account, you can access a $1000 spend limit, letting you pay for purchases interest-free and over four equal, automatic payments.1 You can make payments manually in the Suncorp App at any time. You can even adjust your payment day by up to six days. Worldwide Visa Debit convenience

Suncorp launches buy now, pay later service

Suncorp Bank is introducing a new interest-free buy now pay later (BNPL) offering which can be used to make payments at more than 70 million merchant locations worldwide, wherever Visa is accepted. In a first for the Australian market, Suncorp's PayLater will include both a physical and digital Visa debit card to shop in-store and online.

24 Buy Now, Pay Later Statistics for 2023

Suncorp Bank has today launched PayLater, its interest-free buy now pay later (BNPL) offering, which is available to use at more than 70 million merchant locations worldwide, wherever Visa is accepted*.

SUNCORP Style Now Pay Later Brightworks

Buy it now and pay it back in four easy payments. Use the Suncorp Bank PayLater Visa Debit card worldwide, in-store and online,* for purchases of $50 or more, up to your spend limit of $1,000.

Suncorp Bank enters buy now pay later market with Visa Australian FinTech

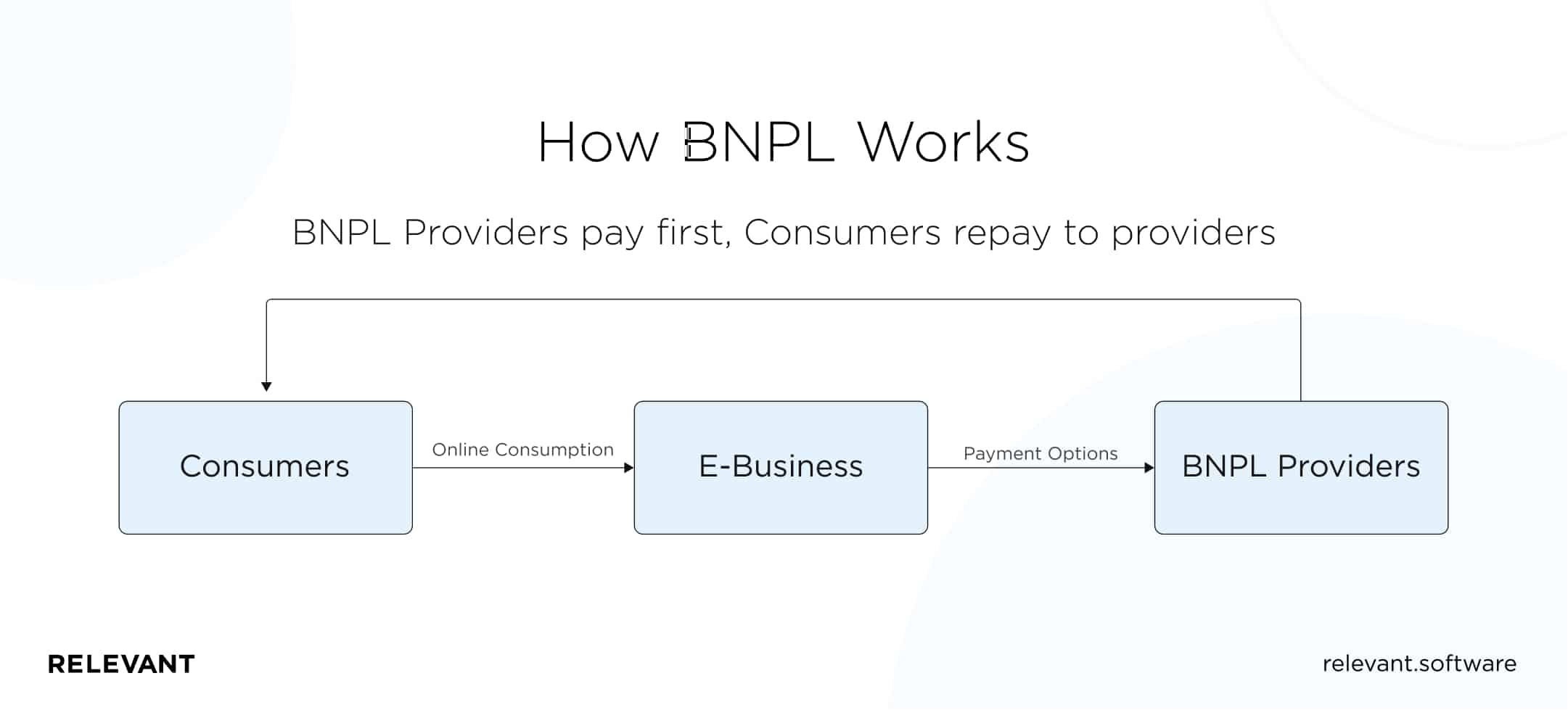

Suncorp has joined the growing buy now, pay later trend (BNPL), teaming up with Visa to launch the interest-free offering, PayLater. BNPL has become one of the most competitive financial products to enter the Australian market in years, with more than half a dozen options available. AfterPay is the dominant player in the increasingly crowded.

Buy Now, Pay Later Jamaican Cravings Box

PayLater will be available for purchases higher than $50, up to a limit of $1,000 once Suncorp determines a customer's eligibility following a credit check. Suncorp says eligible customers will receive "quick approval" after applying online or via the Suncorp App. Repayments will then be made in four equal fortnightly instalments.

Buy Now, Pay Later Offer Instalment Payments PayPal UK

Suncorp is the latest bank to throw its hat into the BNPL ring. Photo: Getty. Suncorp Bank has partnered with Visa to launch a new buy now, pay later (BNPL) service that will cap late payment fees and allow customers to shop in stores. The bank unveiled the new product on Monday and has billed it as a "pay later debit card".

.png#keepProtocol)

What is Buy Now Pay Later ( BNPL )? Comprehensive Guide

Suncorp will join the stampede into the buy now, pay later sector. Attila Csaszar Mr van Horen, the chief executive of Suncorp Bank, said the lender believed there would remain strong demand for credit cards, but at the same time many younger people were opting for BNPL products.

Infographic Credit card killer? The rise of BNPL Tartufocracia

Today, Suncorp Bank has announced that it is broadening its services with a new Buy Now Pay Later (BNPL) offering, PayLater. PayLater will be available to Suncorp customers from November 2021 - however, those who are keen can pre-register to join. How will Suncorp's PayLater work? PayLater is all about flexibility.

Buy Now Pay Later App Development in 2022 Quick Guide

Australia's Suncorp Bank has joined the increasingly crowded Australian buy now pay later (BNPL) market after it announced on Monday (6 September) that it will start offering such services later this year. The bank's new PayLater service will be launched in partnership with Visa in November.

Buy Now Pay Later Solutions BNPL UK

September 6, 2021 19 Views Suncorp, the Australian insurance, banking, and finance firm has announced that it will launch its own buy-now-pay-later service PayLater. With this, Suncorp aims to add more payment options for its customers.

Suncorp announces PayLater, a Buy Now Pay Later debit card

The use of buy now, pay later plans skyrocketed during the 2023 holiday season. According to Adobe , which tracks online sales, buy now, pay later plans use was up 47% on Black Friday and 43% on.

Suncorp Bank enters buy now pay later market with Visa Suncorp Group

Suncorp Bank has partnered with Visa to launch a new buy now, pay later (BNPL) service that will cap late payment fees and allow customers to shop in stores.