¿Qué es la curva de Coppock? Novatos Trading Club

La curva Coppock, diseñada para identificar fondos en los mercados bursátiles, ha ganado reconocimiento y utilidad en diversos ámbitos del análisis técnico. Su naturaleza oscilante proporciona a los inversores valiosa información sobre posibles cambios de tendencia y puntos de entrada al mercado.

La Curva de Coppock Como se Calcula e Interpreta

233 Share 10K views 4 years ago Using Technical Indicators for Stocks and Options Trading / Investing Coppock Curve Indicator Explained Simply and Understandably // Want more help from David.

Curva de Coppock, un indicador de impulso a largo plazo en IQ Option IQ Option wiki

The Coppock Curve indicator is an oscillator based on momentum that identifies long-term trading opportunities in the market. It typically combines the rate of change on two different periods and evaluates the weighted moving average of the combination. KEY POINTS

Coppock Curve YouTube

The Coppock Curve is a technical indicator that provides long-term buy and sell signals for major stock indexes and related ETFs based on shifts in momentum. The indicator is designed for use on.

¿Qué es la Curva de Coppock y cómo se interpreta? Rankia

Iggy_de_la_Varga. 01 Dec. 2022. Comments (3.43K) @Rgrdoc8991 I couldn't fid one.. If you are out of the market and the coppock curve reverses upwards, 9/10 times it would be a good idea to get.

La Curva de Coppock Como se Calcula e Interpreta

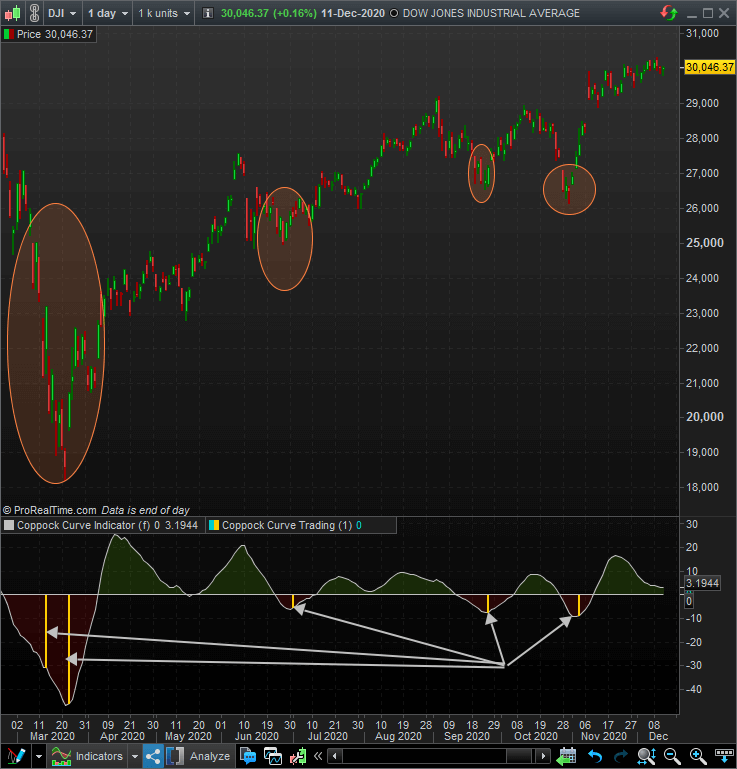

The Coppock Curve was developed by Edwin Sedge Coppock in 1965 to identify long-term buying opportunities in the S&P 500 and Dow Industrials. A buy signal is generated when the indicator crosses zero and enters into positive territory, while a sell signal is generated when the Coppock Curve falls below zero and enters into negative territory..

La Curva de Coppock Como se Calcula e Interpreta

Using The Coppock Curve Indicator For Trading Should Not Include Trading Zero Crosses For Trades.Learn Different Approaches That Can Actually Work!.

Como utilizar o indicador Curva de Coppock

The Coppock curve or Coppock indicator is a technical analysis indicator for long-term stock market investors created by E.S.C. Coppock, first published in Barron's Magazine on October 15, 1962. [1] The indicator is designed for use on a monthly time scale.

¿Qué es la curva de Coppock? Novatos Trading Club

The Coppock Curve is a momentum oscillator originally designed to point out shifts in the long-term trend of stock indexes. It does a good job of pointing out these trend changes on the monthly chart.

La curva de Coppock bolsacanaria.info

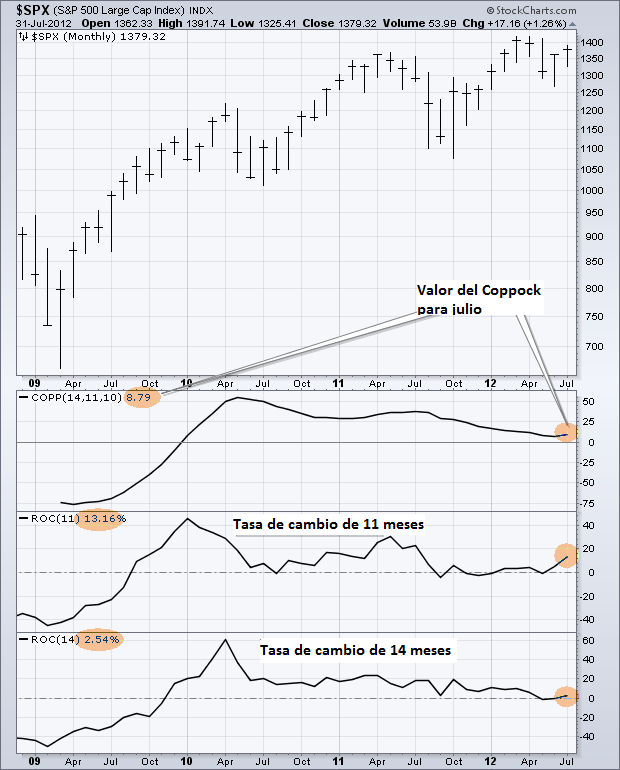

Curva de Coppock = WMA de 10 periodos del ROC de 14 periodos + ROC de 11 periodos Donde: -WMA: Media móvil ponderada -ROC: Tasa de cambio (del inglés Rate of Change) El indicador de tasa de cambio (ROC) es un oscilador de impulso del precio que oscila por encima y por debajo de la línea cero.

CURVA DE COPPOCK, ESTRATÉGIA DAY TRADE MINI ÍNDICE E MINI DÓLAR INVESTIR NA BOLSA DE VALORES

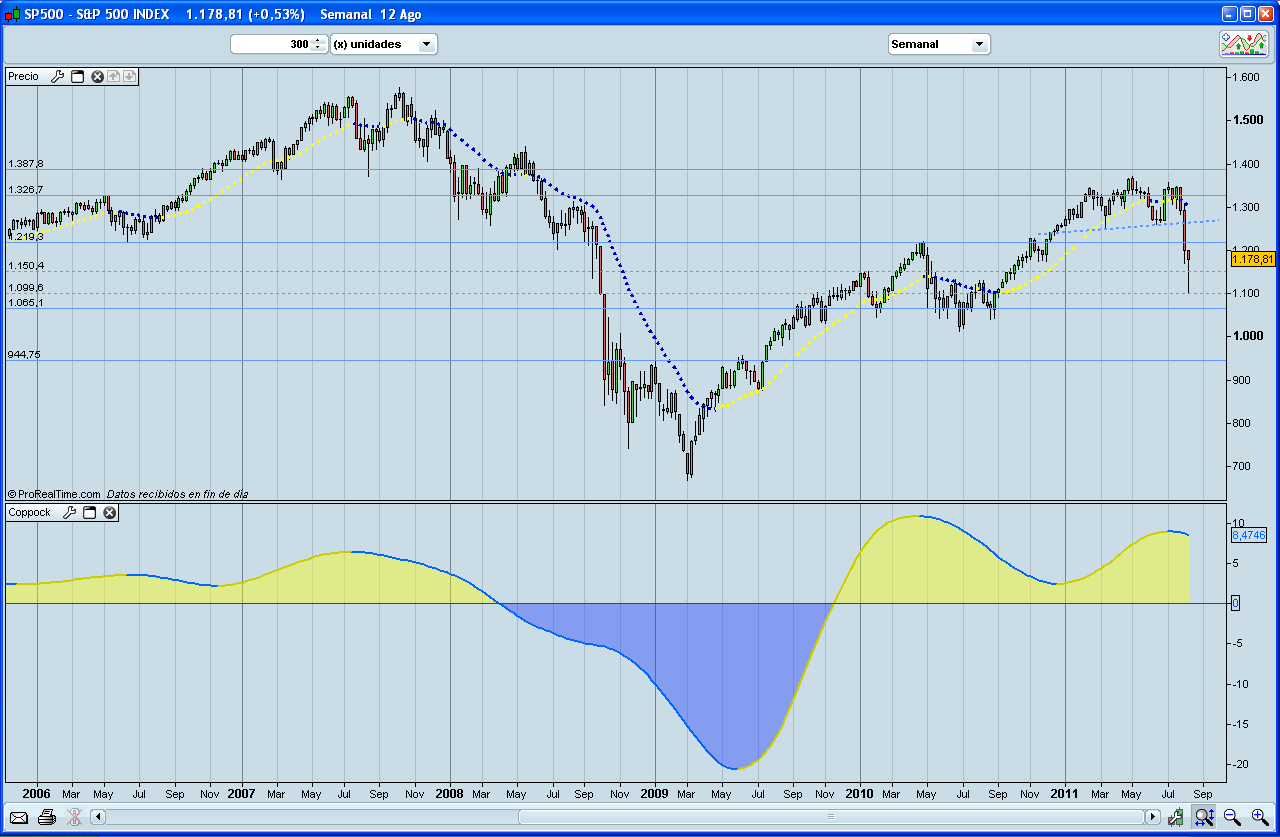

¿Qué es la curva de Coppock? ¿Cómo lo programo en ProRealTime? ¿Qué aspecto tiene la curva de Coppock? La idea principal es programar el indicador de Coppock y tener sentimiento alcista desde que la curva, estando aún en zona negativa, empieza a subir.

Curva de Coppock Traders Studio

The Coppock Curve is a long-term price momentum indicator used primarily to recognize major downturns and upturns in a stock market index. It is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index. It is also known as the "Coppock Guide."

Diseñando indicadores la curva de Coppock Rankia

Coppock Curve = 10-period WMA of (14-period RoC + 11-period RoC) WMA = Weighted Moving Average RoC = Rate-of-Change. The Rate-of-Change indicator is a momentum oscillator that oscillates above and below the zero line. Coppock used 11 and 14 periods because, according to an Episcopal priest, this was the average mourning period when grieving the loss of a loved one.

Indicador Curva De Coppock Leyendo Reversiones De Mercado

La Curva de Coppock es un indicador del impulso de los precios para determinar los principales mínimos en el mercado de valores y se calcula como una media móvil. Se dice que la Curva de Coppock se desarrolló para estrategias a largo plazo con índices, ETF y otros instrumentos líquidos, más que para el trading intradía.

La curva de Coppock

The Coppock Curve is a lagging indicator that relies on historical data to generate signals. As a result, it may provide late entry points into the market, potentially missing out on a significant portion of a new trend. Additionally, the indicator may produce false signals in highly volatile markets. Don't Settle for Ordinary Trading Software

MANUAL. OPERATIVA CON CURVA COPPOCK + MM50 (TRG) FDAX TF 2 min De Inversor a Trader

La curva de Coppock se puede calcular de la siguiente manera: Curp Coppock = WMA 10 de (ROC 14 + ROC 11 ) Dónde: WMA10 = media móvil ponderada de 10 períodos ROC14 = tasa de cambio de 14 períodos ROC11 = Tasa de cambio 11 períodos Al dar esta fórmula, siga los siguientes pasos: