Rate these 0100 (Görüntüler ile)

NIKE, Inc. (NYSE:NKE) today reported financial results for its fiscal 2020 fourth quarter and full year ended May 31, 2020. Fourth quarter reported revenues were $6.3 billion, declining from prior year as the majority of NIKE-owned and partner stores in North America, EMEA and APLA were closed due to the COVID-19 pandemic. NIKE digital sales increased 75 percent in the fourth quarter, or 79.

Nike Timing Triax C5 Heart Rate Monitor Watch

NIKE, Inc. (NKE) NYSE - NYSE Delayed Price. Currency in USD Follow 2W 10W 9M 102.08 -0.22 (-0.22%) At close: 04:00PM EST 102.12 +0.04 (+0.04%) Pre-Market: 07:03AM EST Currency in USD See NIKE,.

Rate the collection r/Nike

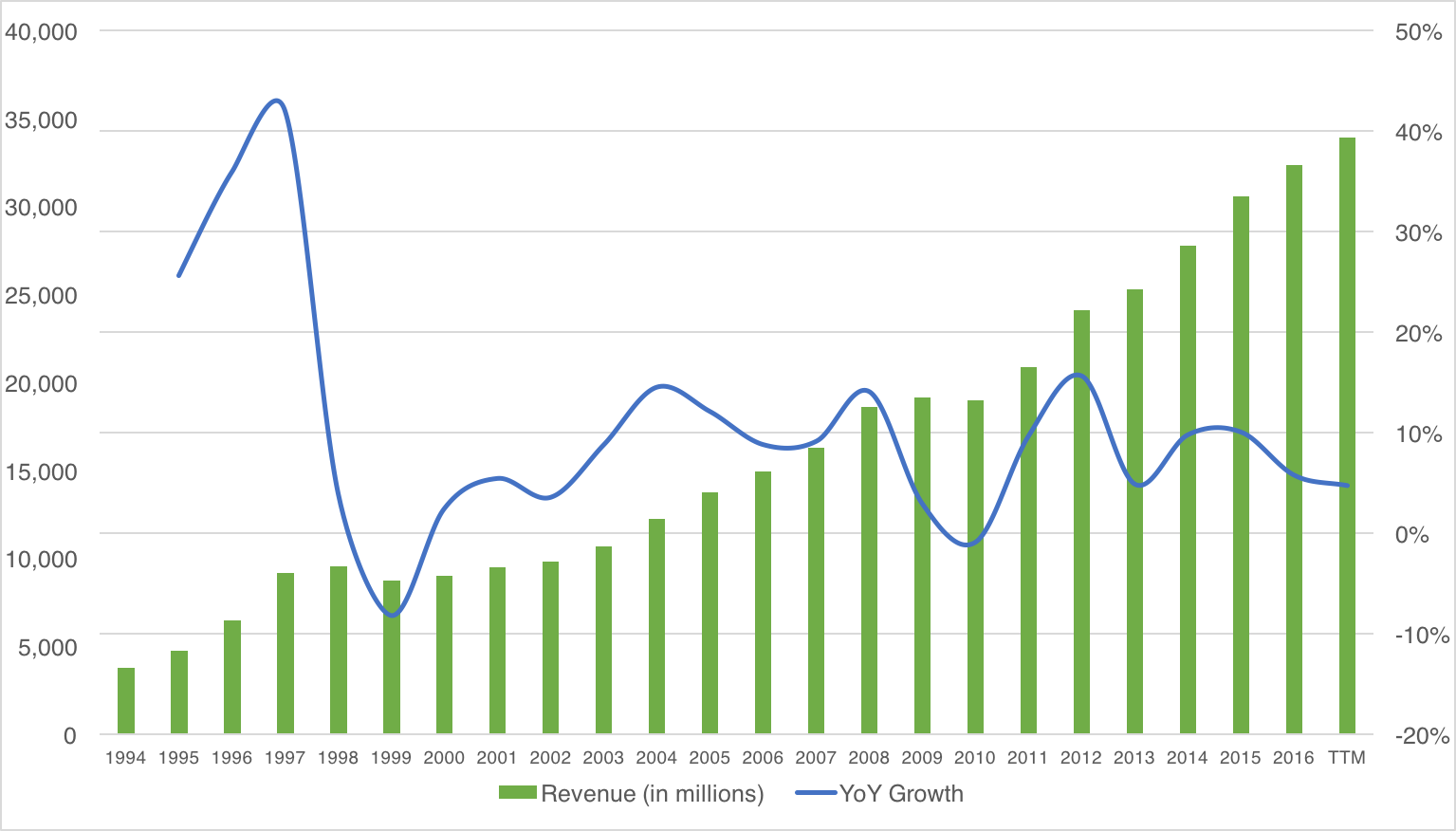

Nike acquired Virgin Mega, a digital design studio, in 2016. Nike acquired Starter in 2004 and sold it in 2007 for $60 million. [ 10] Nike acquired Umbro in 2007 and sold it in 2012 for $225 million. [ 11] Nike acquired Bauer Hockey in 1994 and sold it for $200 million in 2008. [ 12] Nike acquired Cole Haan for $80 million in 1988 and sold it.

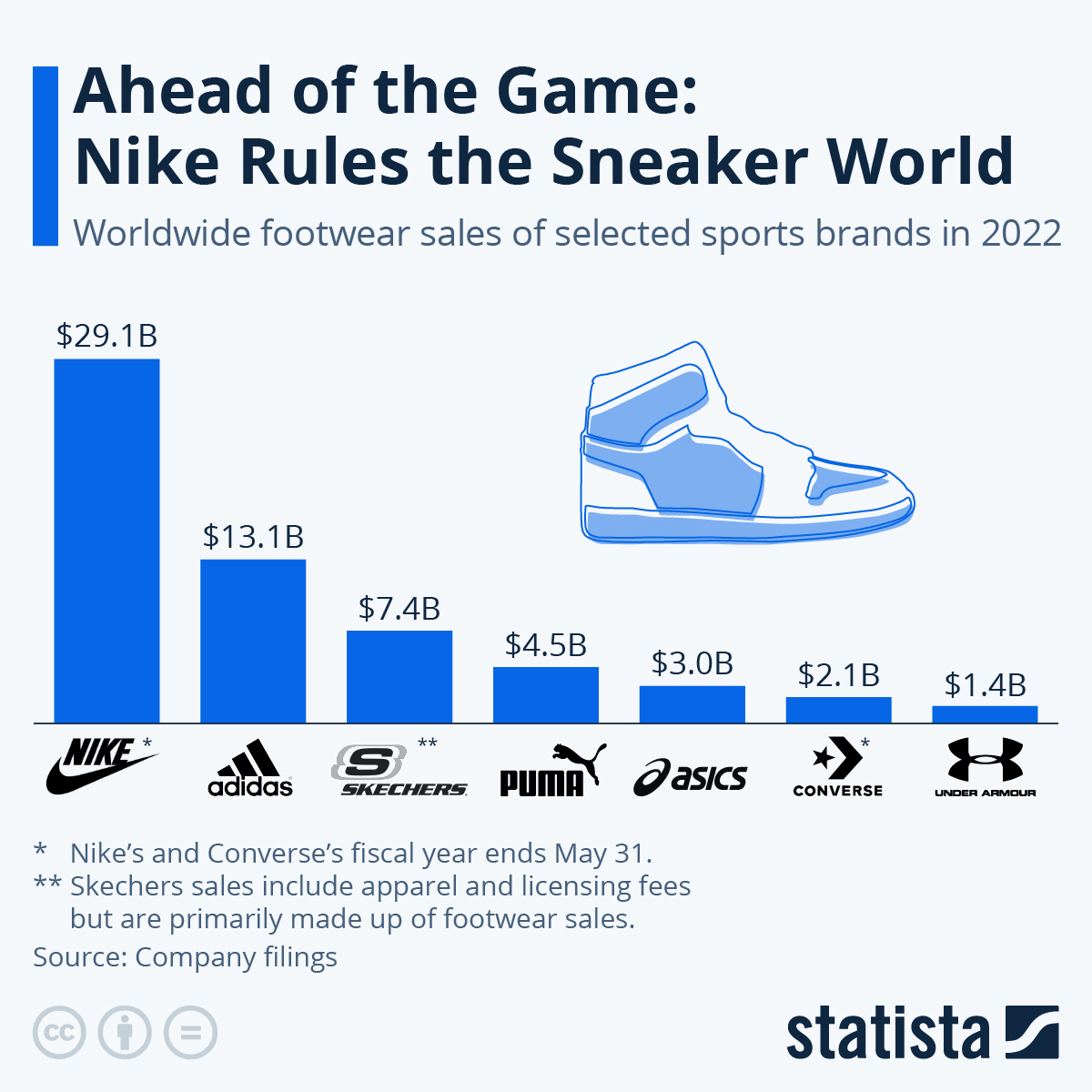

Chart Ahead of the Game Nike Rules the Sneaker World Statista

2W 10W 9M 102.08 -0.22 (-0.22%) At close: 04:00PM EST

Nike Customer Experience Review On the Right Path Ric Merrifield

06/24/2021 BEAVERTON, Ore.-- (BUSINESS WIRE)-- NIKE, Inc. (NYSE:NKE) today reported financial results for its fiscal 2021 fourth quarter and full year ended May 31, 2021. Fourth quarter reported revenues were $12.3 billion, up 96 percent compared to prior year and increasing 21 percent compared to the fourth quarter of 2019.

Nike Timing Triax C8 Heart Rate Monitor Watch

Market overview Financial performance Revenue by region Key figures Competitors Nike brand profile Editor's Picks Current statistics on this topic Apparel & Shoes Nike's global revenue.

nike risk free rate new listing

Nike Inc Follow Share $103.62 After Hours: $103.50 (0.12%) -0.12 Closed: Jan 8, 4:00:36 PM GMT-5 · USD · NYSE · Disclaimer search Compare to Amazon.com Inc $149.10 AMZN2.66% Apple Inc $185.56.

Nike Fitness Tracker With Heart Rate Wearable Fitness Trackers

Price vs Fair Value Sustainability Trailing Returns Financials Valuation Operating Performance Dividends Ownership Executive $103.62 +1.54 (1.51%) View Full Chart As of Jan 8, 2024 1:10pm Delayed.

Rate these 0100nikeshoes Nike shoes, Shoes, Puma sneaker

Nike's valuation is, admittedly, somewhat high. Its current P/E ratio hovers around 35, which is well above the industry average. However, I believe that now is a good time to buy for a few.

Nike Rate Their Own Boots The Official Scorecard Soccer Cleats 101

In short, I rate Nike a buy under $100. Source: www.nike.com. Superior Presence. Nike generates approximately 66% of its revenue from its footwear segment. Further, Nike is the largest footwear.

Rate these 0100 Follow _tn_nike_... Check more at https//nailartm

The effective tax rate was 9.1 percent, compared to 14.0 percent for the same period last year, due to a shift in our earnings mix and a non-cash, one-time benefit related to the onshoring of our non-U.S. intangible property.

Should You Buy Nike Stock? The Compound Investor

NIKE annual/quarterly revenue history and growth rate from 2010 to 2023. Revenue can be defined as the amount of money a company receives from its customers in exchange for the sales of goods or services. Revenue is the top line item on an income statement from which all costs and expenses are subtracted to arrive at net income.

Nike rate complètement sa campagne de comm' autour de Cristiano Ronaldo

1 Colour. $175. Air Jordan 1 Low. Air Jordan 1 Low. Men's Shoes. 1 Colour. $150. Nike Air Max 97.

Nike Is Worth 30 A Share NIKE, Inc. (NYSENKE) Seeking Alpha

Find out all the key statistics for NIKE, Inc. (NKE), including valuation measures, fiscal year financial statistics, trading record, share statistics and more.

Rate these 0100 Sneakers, Sneakers nike, Air max sneakers

8.36203$ UAA -0.1% PUMA 47.73€ PMMAF 0.08%

AGIKgqMPlQF3iLCHlQqa9amXkAlqReRXEICw71MMLSZ=s900ckc0x00ffffffnorj

Weaknesses. With a 2024 P/E ratio at 28.4 times the estimated earnings, the company operates at rather significant levels of earnings multiples. The company appears highly valued given the size of its balance sheet. The company is highly valued given the cash flows generated by its activity.