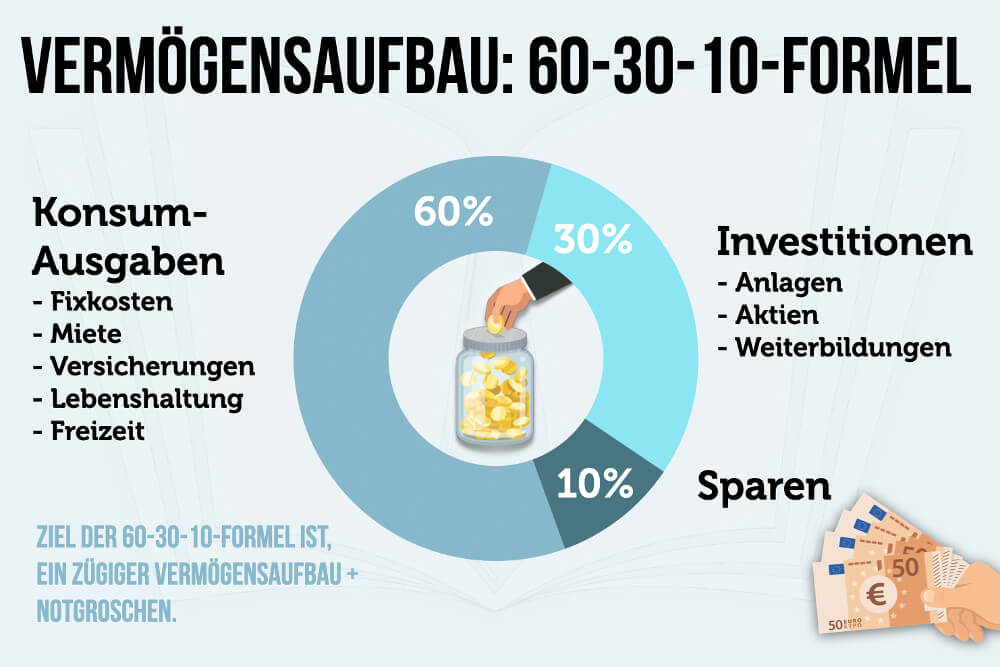

503020Regel Clever Geld sparen + Kapital aufbauen

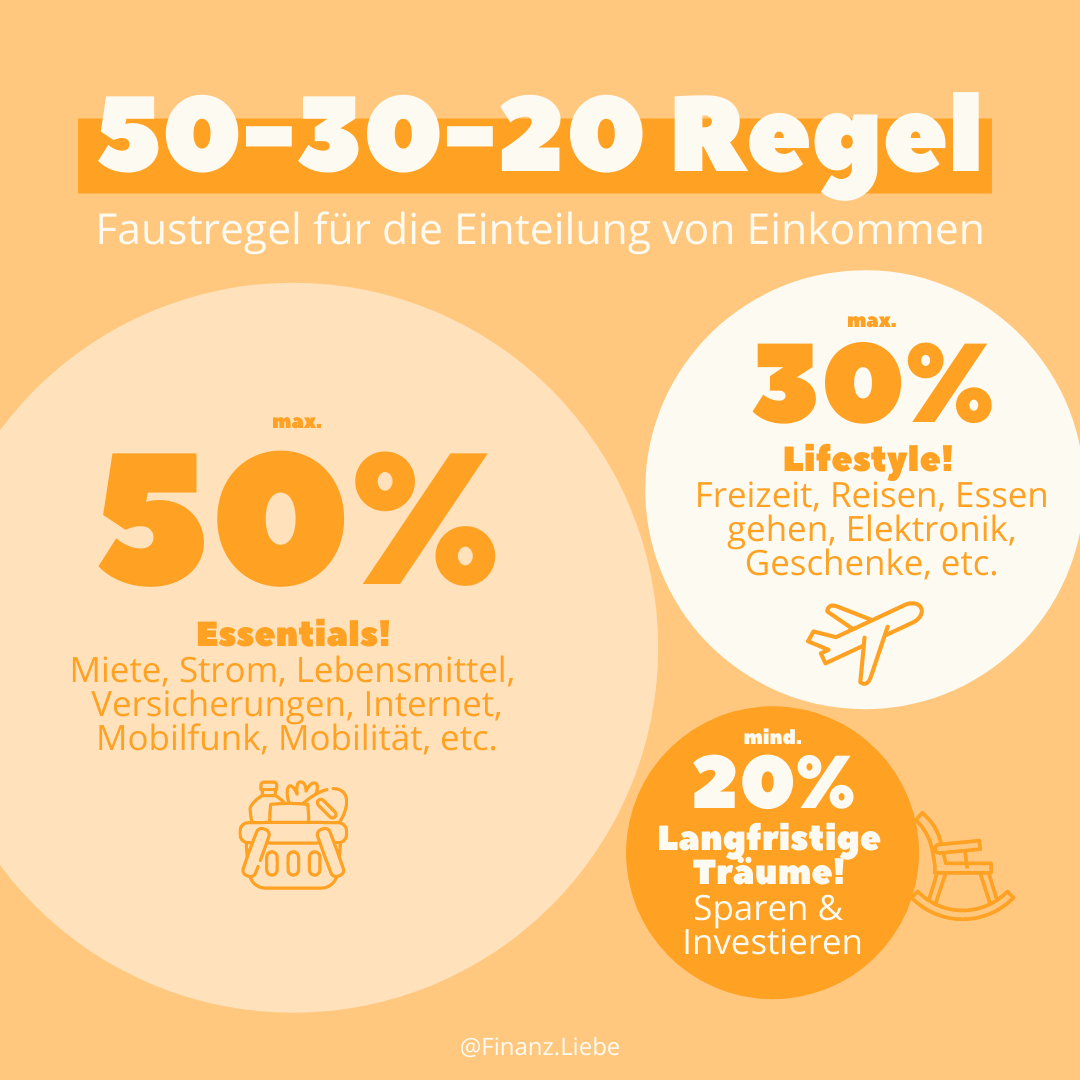

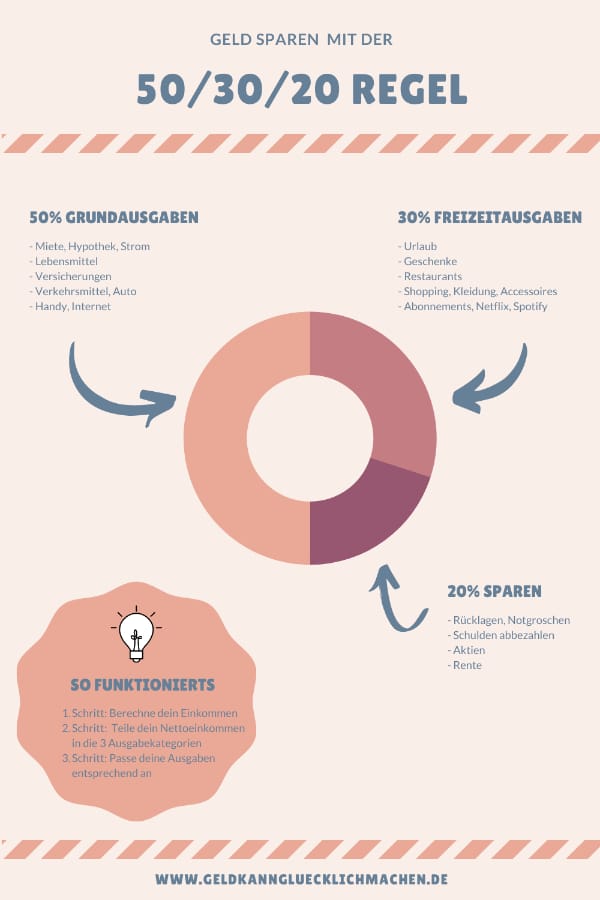

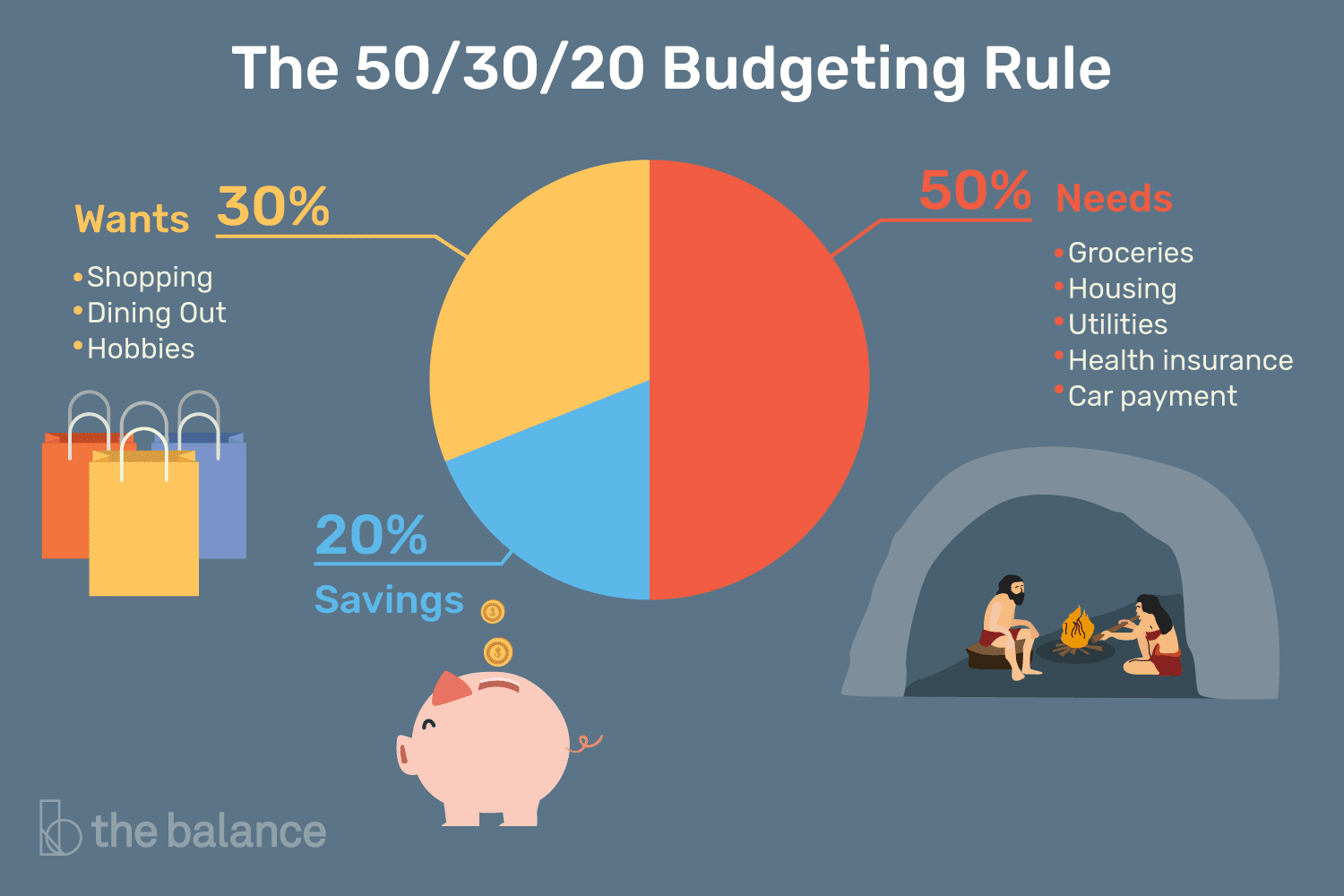

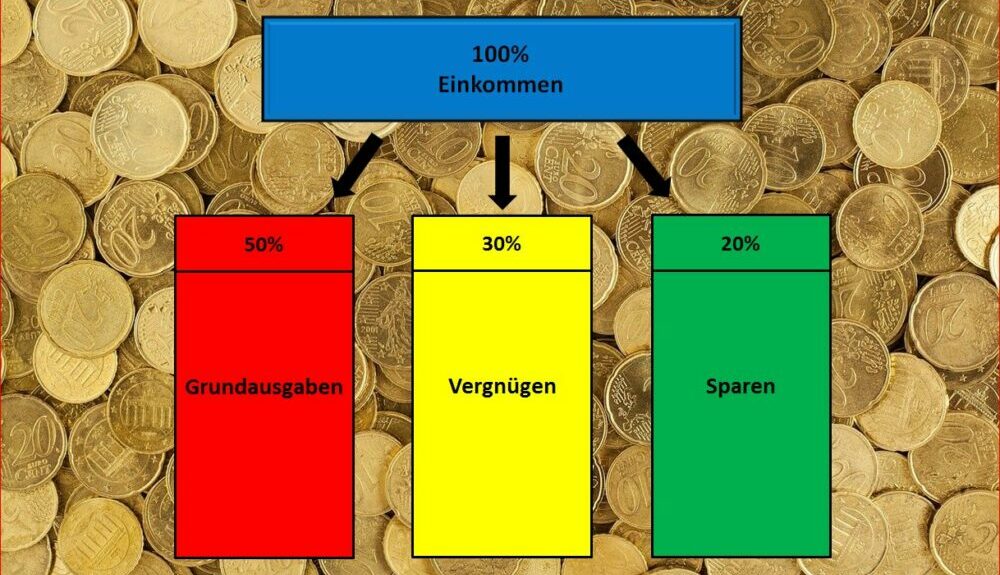

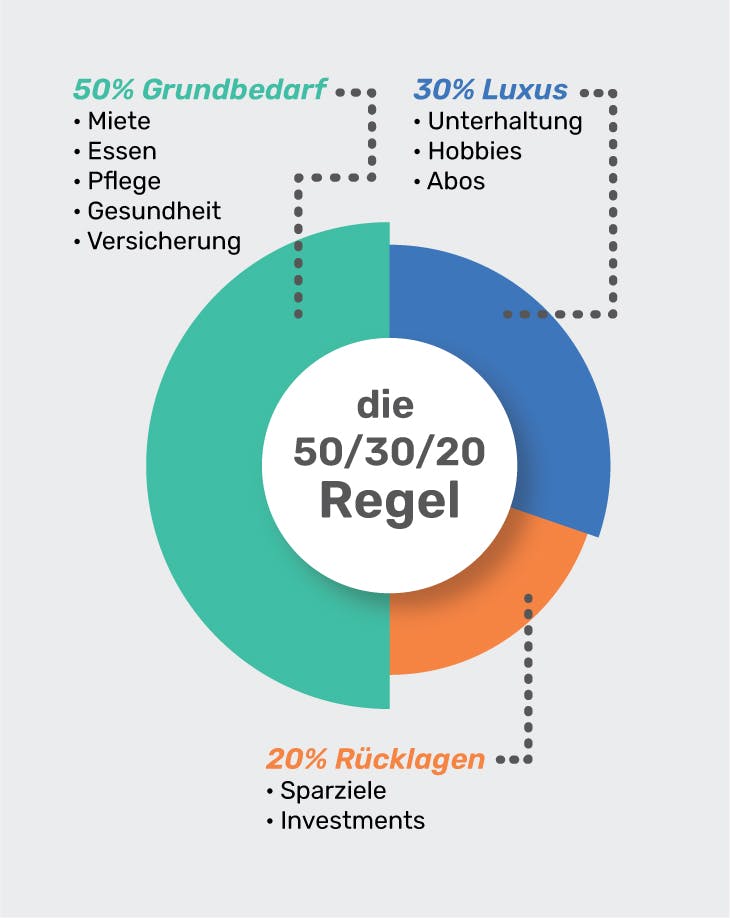

50% of your incom e should go towards your needs. This includes housing expenses, food, transportation, child care, etc. 30% of your income should go toward things you want, like travel, restaurants, entertainment, and luxury products. 20% of your income should serve your financial goals. This includes debt reduction, cash savings, and investments.

Wie du mit der 503020 Regel clever Geld sparst

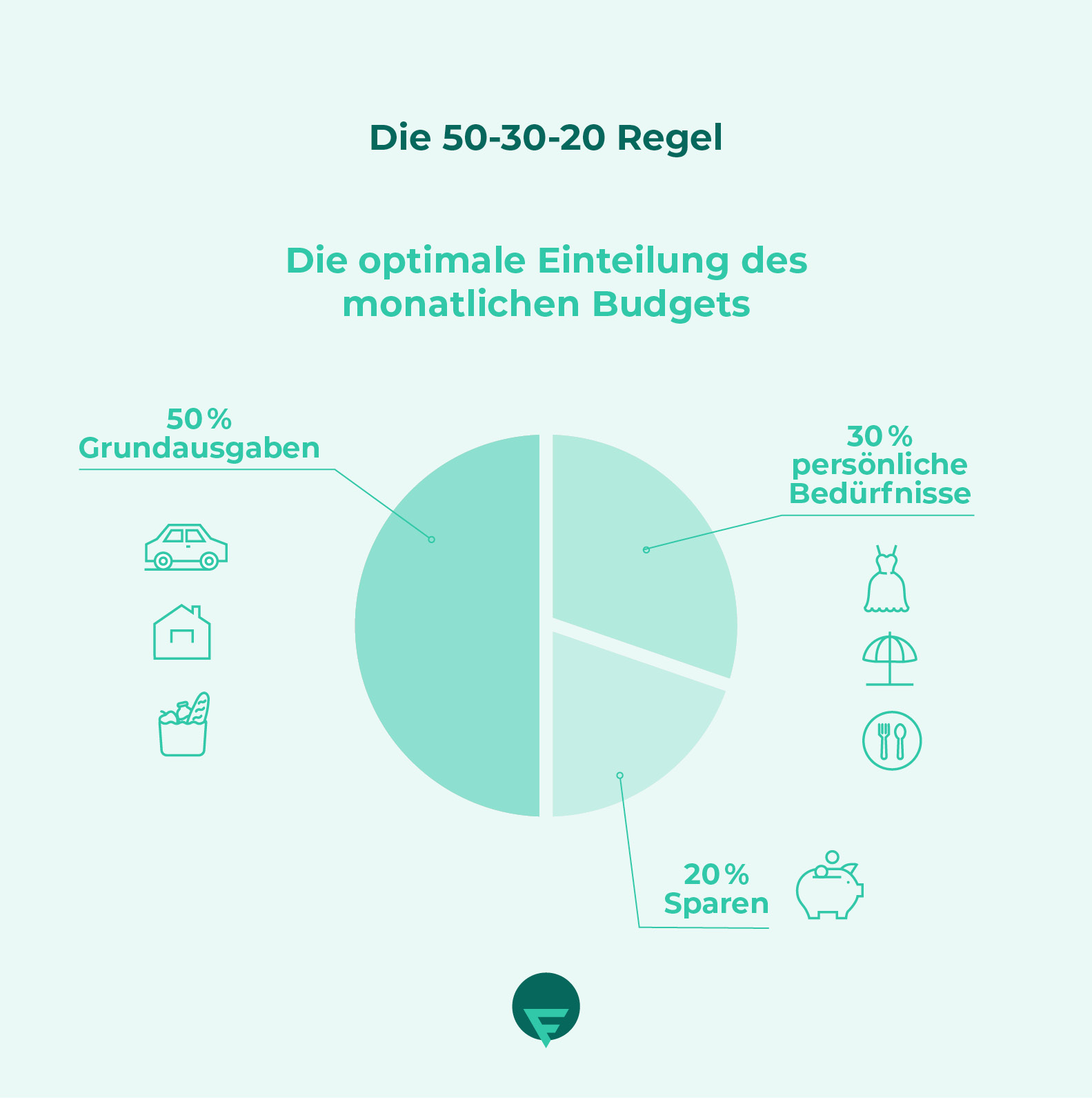

Die 50-30-20-Regel ist eine Sparmethode, die Dir dabei hilft, Dein Budget zum Leben und Sparen im Auge zu behalten. In diesem Ratgeber erklären wir Dir, was die 50-30-20-Regel ist und wie Du mit der Budgetierungsmethode Monat für Monat Geld sparen kannst.

Die 503020Regel um das Einkommen zu budgetieren FinanzLiebe

AboutTranscript. The 50-30-20 rule is a suggested budgeting guideline that advises allocating 50% of your income to necessities (like rent, groceries, and utilities), 30% to discretionary spending (like hobbies, entertainment, and travel), and 20% to savings. The goal is to create a balanced budget that allows you to cover your needs, enjoy.

Tipps zum Geldsparen im Alltag comdirect Magazin

UPDATED: Nov 25, 2023. The 50/30/20 rule divides your income into three categories: 50% for needs, 30% for wants and 20% for debt repayment and savings. The rule is a solid starting point for a monthly budget, and you can tweak the percentages to fit your evolving financial situation. Follow along to find out how to use the rule to your advantage.

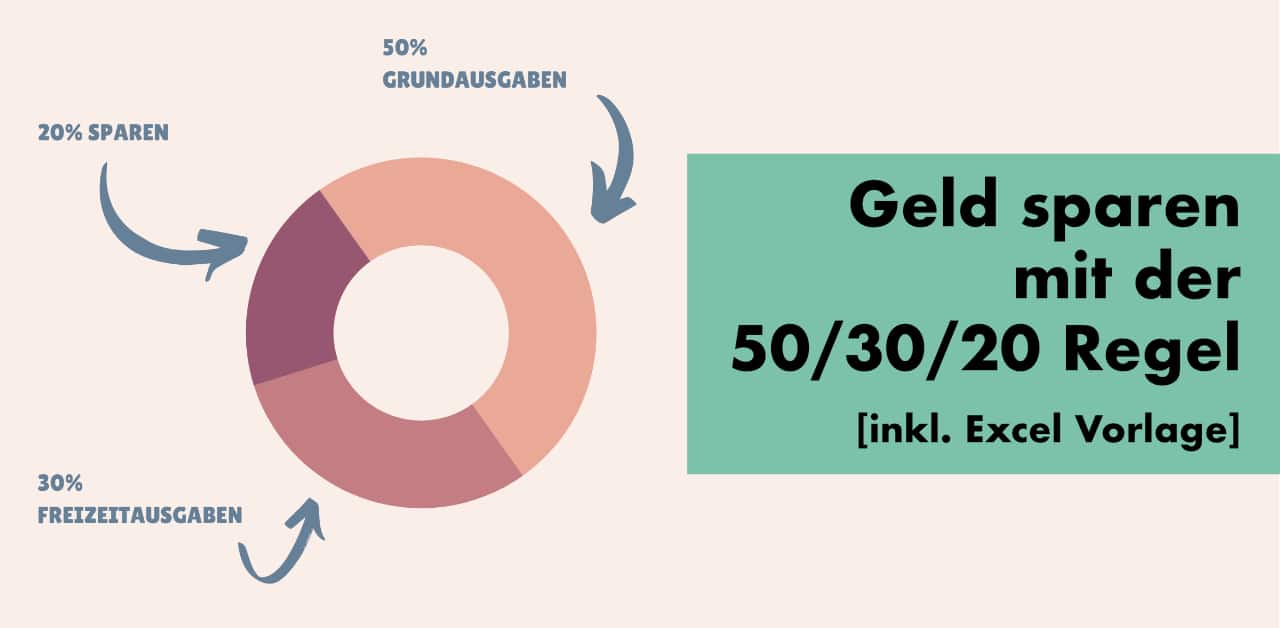

Geld sparen mit der 503020Regel (inkl. Excel Vorlage)

The 50/30/20 rule is a budgeting plan designed to help you manage your finances. The concept first emerged in Elizabeth Warren (the US Senator) and her daughter's book, "All Your Worth: The Ultimate Lifetime Money Plan." According to this personal finance guide, you have to balance your income into three categories:

503020 Regel So sparst du Geld [Ratgeber] Geldschnurrbart.de

What is the 50/30/20 rule? Although it's commonly referred to as a rule, 50/30/20 is really just a guideline. It suggests that if you can balance your expenses and other spending to stay within 80% of your after-tax income and dedicate the remaining 20% to savings and debt repayment, you'll be on a sustainable path to financial security.

503020 Regel so spart man richtig finavo.at

Mit der 50-30-20-Regel Deine Sparquote festlegen. 50% Deines Nettoeinkommens solltest Du - wenn es geht - für den Lebensunterhalt ausgeben. Also für Dinge, um die Du nicht herumkommst, wie zum Beispiel: Warmmiete bzw. Kreditrate fürs Haus, Nebenkosten und Rücklagen für Deine eigene Immobilie. Für diesen Posten allein sind 30% ein.

What is the 50/30/20 Rule Budget? Paragon Bank

50/30/20 explained. The basic idea of the 50/30/20 rule is simple. You allocate 50% of your post-tax income to "needs" and another 30% to "wants.". That leaves you with at least 20% of.

The 50/30/20 Rule — A QuickStart Guide to Budgeting

The 50/30/20 rule says to spend 30% of your take-home pay on the stuff that improves your standard of living. This includes things like: Unlimited data plans. Restaurants. New clothes (not because your kid outgrew his jacket but because you fell in love with a cute new jacket) Sporting events. Concert tickets.

Die 503020Regel > sparerinfo.de

50/30/20 budget calculator. Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt.

Mit der 503020 Regel Geld sparen in 2021 Geld sparen, Geld, Sparen

Key Takeaways. The 50/30/20 rule of thumb is a guideline for allocating your budget accordingly: 50% to "needs," 30% to "wants," and 20% to your financial goals. The rule was popularized in a book by Elizabeth Warren and her daughter, Amelia Warren Tyagi. Your percentages may need to be adjusted based on your personal circumstances.

Geld sparen mit der 503020Regel (inkl. Excel Vorlage)

The 50/30/20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after-tax income (i.e., your take-home pay): 50% to needs, 30% to wants and.

Mit der 503020 Regel Geld sparen

Een rekenvoorbeeld met de 50/30/20-regel. Hoe de 50/30/20-budgetregel voor u kan werken, ziet u in het rekenvoorbeeld hieronder. Netto inkomen: € 2.200. 50% naar vaste lasten: € 1.100. 30% naar persoonlijke uitgaven: € 660. 20% naar sparen en schulden: € 440. Op jaarbasis houdt u zo € 5.280 euro over voor het sparen en aflossen van.

503020Regel Kontrolle über deine Finanzen bekommen

Die 50/30/20-Regel ist eine Sparmethode, bei der man 50% für Fixkosten wie Miete, 30% für den Lifestyle wie Restaurantbesuche und 20% fürs Sparen auszugeben. Erfahren Sie, wie die Regel funktioniert, welche Vor- und Nachteile sie hat und wie Sie sie umsetzen können.

503020 Regel Die goldene Regel der Finanzplanung

To follow the 50/30/20 budgeting rule, put your after-tax income into three categories: 50% for needs, 30% for wants and 20% for savings or debt repayment. Needs: 50%

503020Regel Clever Geld sparen + Kapital aufbauen

Die 50-30-20-Regel stammt ursprünglich aus dem 2005 erschienenen Buch "All Your Worth: The Ultimate Lifetime Money Plan" von Elizabeth Warren, Expertin für Insolvenzrecht, frühere Harvard-Professorin und US-Senatorin, sowie ihrer Tochter Amelia Warren Tyagi.. Mit über 20 Jahren Forschungserfahrung bestätigen Warren und Tyagi unsere Meinung: Um die eigenen Finanzen in den Griff zu bekommen.